In the world of Bitcoin mining, a sigh of relief was heard across the United States. The controversial Digital Assets Mining Energy (DAME) excise tax proposal, which sought to impose a tax on crypto miners, did not make it into a bill set to raise the U.S. debt ceiling. However, the question remains: is this tax dead and buried, or is it set to rise from the ashes?

The Controversial DAME Tax

The DAME tax proposal was a hot topic of debate. It aimed to charge crypto miners a tax equal to 10% of the cost of the electricity they used for mining in 2024, before scaling up to 30% in 2026. Critics argued that this tax could potentially increase global emissions as miners might be forced to relocate to countries where energy production may produce more emissions.

The Victory for Bitcoin Miners

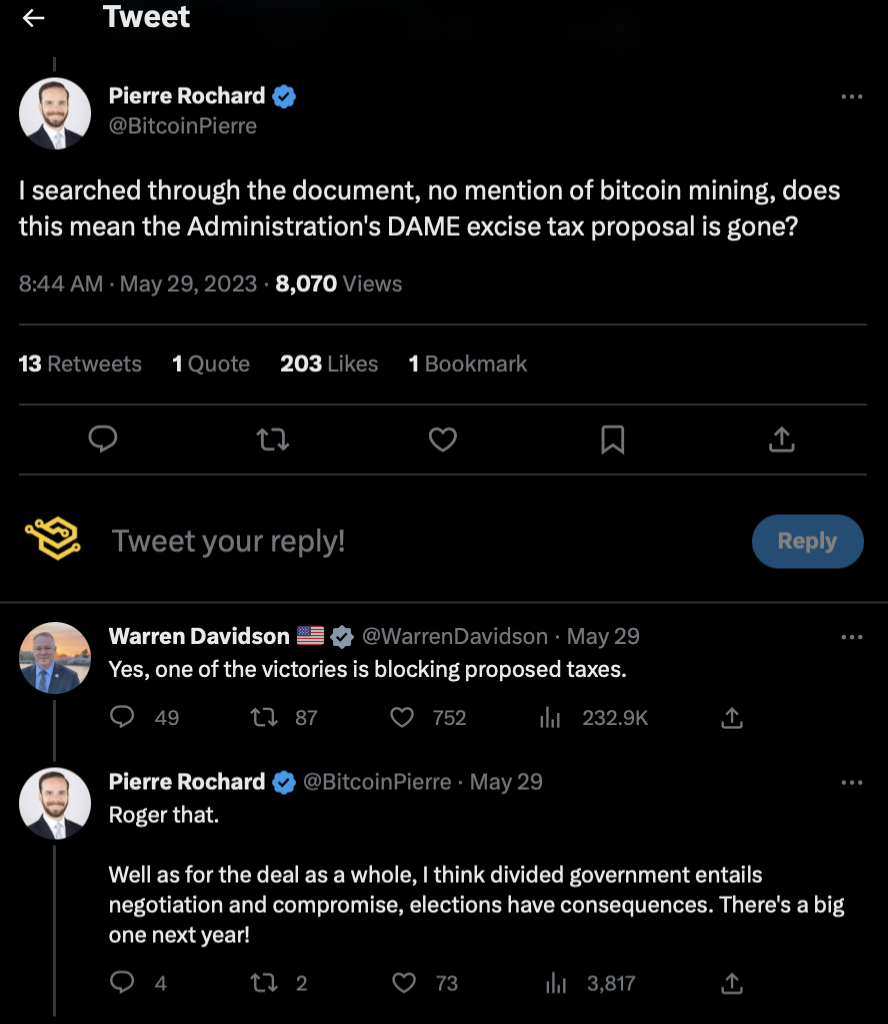

The news of the tax’s omission from the bill broke after Bitcoin miner Riot Platforms vice president of research, Pierre Rochard, noted that the proposed bill did not include any mention of the DAME tax. Representative Warren Davidson replied that this was “one of the victories” of the bill.

The Future of the DAME Tax

While many online discussions suggested the proposal was “dead,” others, such as Coin Metrics co-founder Nic Carter, highlighted that it was only temporarily defeated, alluding to the possibility of it being included in future bills. Carter suggested that the administration would likely attempt to sneak it into some omnibus bill if it had the political currency to do so.

The Political Landscape

However, for a bill to pass, it must go through both Congress and the House. Considering the Republican party, which is generally opposed to increases in taxes, currently controls the House, it seems unlikely such an omnibus bill would make it to the president’s desk.

The Assurance from Senator Cynthia Lummis

During a fireside chat at the Bitcoin 2023 conference in Miami, Senator Cynthia Lummis assured viewers that the DAME tax “isn’t going to happen.” She emphasized the importance of ensuring Bitcoin mining firms remain in the U.S. for both national security and energy security, highlighting how Bitcoin mining can reduce gas flaring emissions and help stabilize the energy grid.

The Damage Done?

Regardless of whether President Joe Biden’s administration decides to keep pursuing the DAME tax, it will continue its anti-crypto agenda, according to Bitcoin miner Marathon Digital Holdings CEO Fred Thiel. He suggested that this administration will continue to broadly oppose the crypto sector, and even if this specific tax is no longer on the table, it is likely not the last of misguided, targeted efforts to bring this industry down.

The Impact on Business Decisions

Thiel highlighted how the actions of the U.S. government and regulators weigh in on business decisions. “Regardless of the DAME tax’s likelihood of passing, Marathon has already begun diversifying the locations of our operations,” he said. With regulation around mining being nebulous, his firm has made the strategic decision not to concentrate its footprint in the U.S. but rather diversify its operations.

Conclusion

The future of the DAME tax remains uncertain. However, its impact on the crypto industry is already being felt, with businesses making strategic decisions to diversify their operations. As the debate continues, the crypto industry will be watching closely to see what the future holds for this controversial tax.