Ben Rose, General Manager of Binance Australia, shared insights into Australia’s digital asset regulation during the Intersekt Fintech conference in Melbourne. In a recent interview, Ben Rose, General Manager of Binance Australia, expressed optimism regarding the evolving digital asset regulations in Australia. This optimism comes in the wake of regulatory hurdles and challenges that Binance Australia has faced.

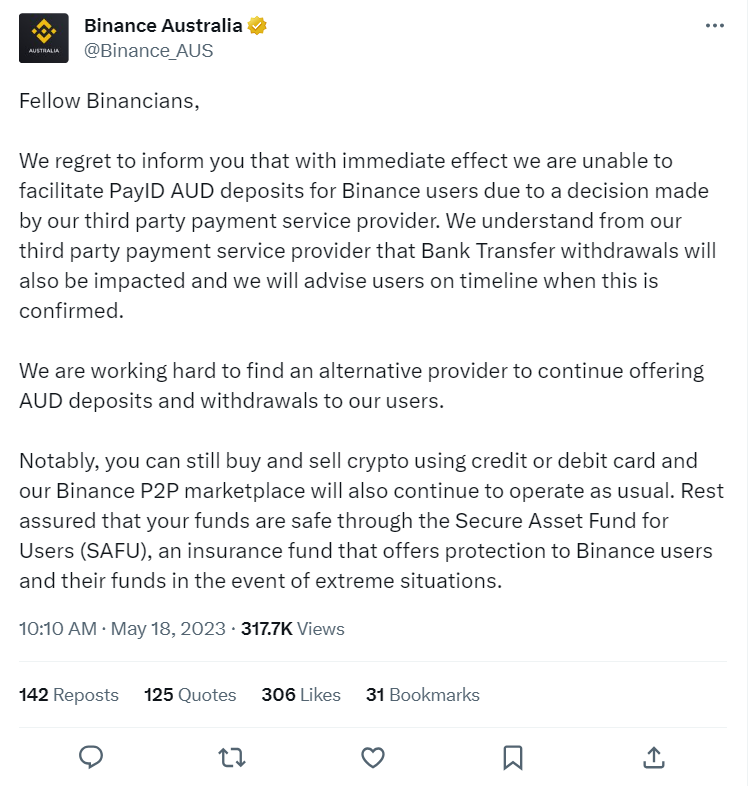

Binance Australia encountered an unexpected disruption in May when its payment provider abruptly terminated services, citing concerns about a “high risk” of scams and fraud.

This move resulted in the suspension of Australian dollar deposits and withdrawals for Binance Australia customers, linked to actions by an undisclosed third-party service provider, rumored to be Westpac, a major Australian bank. Additionally, the Commonwealth Bank (CBA) imposed partial restrictions on bank payments to crypto exchanges due to concerns about scams and financial losses for customers.

ASIC Inquiries

The Australian Securities and Investments Commission (ASIC) conducted investigations at Binance Australia’s offices in July, particularly focusing on the classification of clients as retail or wholesale investors. This scrutiny followed Binance’s earlier announcement in April about closing its local derivatives exchange due to incorrect user classifications.

Binance’s Commitment

Despite these challenges, Binance reiterated its commitment to collaboration with local authorities and compliance with regulatory standards in Australia. Rose emphasized their determination to restore banking relationships and fiat ramp services for their one million Australian customers, stating that they are actively working towards necessary changes.

Rose remains optimistic about the future of crypto regulation in Australia. He highlighted the upcoming Treasury consultation on licensing frameworks, expressing confidence that it will significantly impact the regulatory landscape. Rose also highlighted the positive engagement between industry stakeholders and regulators, indicating progress towards finding common ground.

Industry Insights on Crypto Regulation

During Australian Blockchain Week, Christian Westerlind Wigstrom, representing Monoova, a payment provider in Australia, noted increased discussions between major crypto exchanges and policymakers. He stressed the importance of nuanced dialogues between regulators, banks, and crypto industry leaders, advocating for proactive collaboration.

Trevor Power, an Australian Treasury assistant secretary, discussed the framework for classifying tokens based on function and purpose during the same event. He anticipated the emergence of crypto-specific legislation around 2024, contingent on lawmakers’ response to the framework. Power emphasized the framework’s technology-agnostic approach, designed to easily classify tokens based on their characteristics and value proposition, fostering a flexible regulatory structure for the diverse crypto landscape.