In a recent shift of perspective, Antonio Juliano, the visionary behind the decentralized exchange dYdX, has delivered a noteworthy recommendation to cryptocurrency builders. His advice? Divert your focus away from the United States and concentrate on non-US markets for the next five to ten years.

Juliano’s counsel arrives as a strategic call to action, urging cryptocurrency innovators to consider alternative markets. He argues that by doing so, they can steer clear of the challenges posed by the US regulatory landscape and foster an environment conducive to platform expansion and user adoption. According to Juliano, this strategy, especially advantageous for startups, can expedite scaling processes and offer a more favorable trajectory for growth.

“Delay Serving US Customers for Now”

Addressing startups in particular, Juliano’s message is unequivocal: “Crypto builders should just give up serving US customers for now and try to re-enter in 5-10 years[…] Most of the market is overseas anyways. Innovate there, find PMF [product market fit], then come back with more leverage.” His perspective underscores the opportunity for cryptocurrency pioneers to venture into markets less encumbered by regulatory complexities, allowing them to fine-tune their offerings and garner valuable experience before reentering the US market with enhanced strategic leverage.

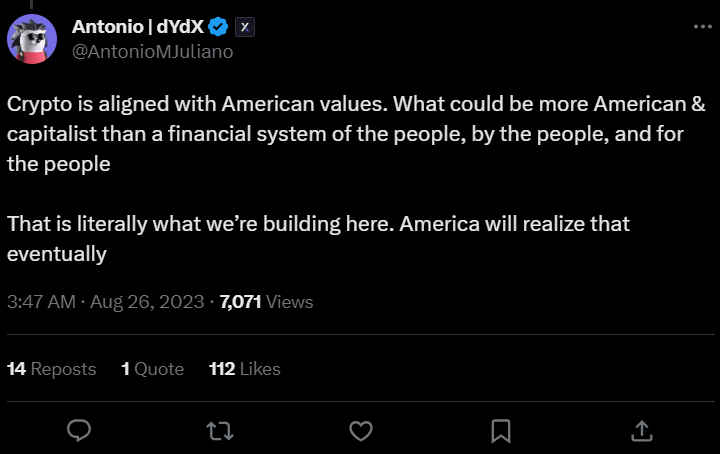

Juliano underscores the pivotal role of robust industry growth in shaping the landscape of cryptocurrency regulations. While acknowledging the ongoing challenges posed by unclear regulations in the US, he accentuates the importance of amassing global-scale adoption and influence to exert a meaningful impact on shaping effective policies.

Diverging Views and Future Trajectories

While Juliano’s advice champions an extended timeline for building and returning to the US market, Brian Armstrong, the CEO of Coinbase, expresses a differing viewpoint. Armstrong foresees a potentially shorter span for improvement in US regulatory frameworks. The varying perspectives reflect the intricate balance between navigating immediate challenges and pursuing long-term strategic goals.

Antonio Juliano’s counsel to cryptocurrency builders reverberates as a call for strategic recalibration. By emphasizing the potential for growth and innovation in non-US markets, he encourages startups to forge a path that minimizes regulatory hurdles and maximizes platform expansion. While perspectives on regulatory timelines differ, the underlying drive to achieve global-scale adoption remains a unifying force in the evolution of the cryptocurrency landscape.