Coinbase, the largest cryptocurrency exchange in the United States, has achieved a significant milestone by securing an Anti-Money Laundering (AML) compliance registration from the Bank of Spain. This achievement marks a pivotal moment in Coinbase’s European expansion strategy, allowing it to operate as a registered cryptocurrency exchange in Spain. In a blog post released on a Friday, Coinbase announced its expansion into the Spanish market, offering users in the country a secure platform to store, buy, and sell digital assets using the euro.

The registration with the Bank of Spain is a testament to Coinbase’s commitment to regulatory compliance in its global operations. It enables Coinbase to offer its full range of products and services, catering to both retail and institutional users in Spain, all while adhering to the country’s legal framework. Over the past year, Coinbase has been on a regulatory compliance journey, obtaining Virtual Asset Service Provider (VASP) registrations in various European countries, including Italy, Ireland, and the Netherlands. Furthermore, Coinbase has received in-principle approval and successfully launched its services in Singapore, Brazil, and Canada.

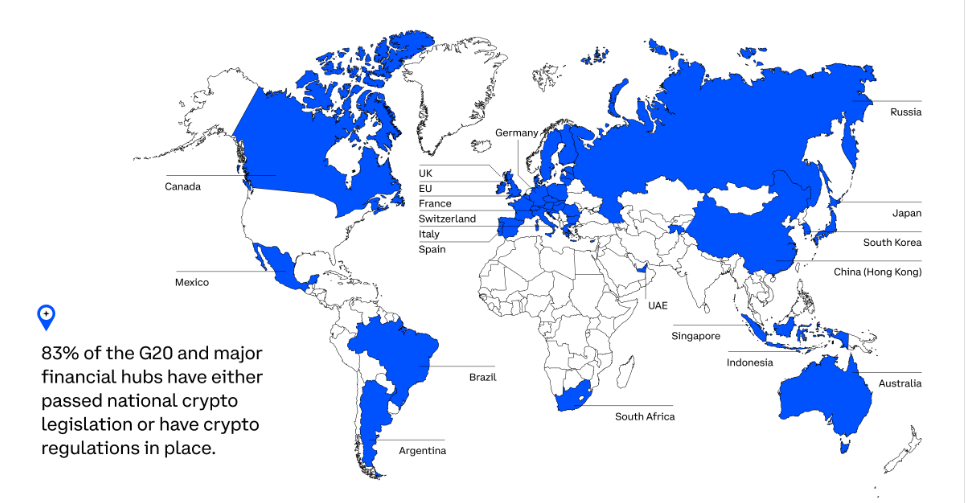

Nana Murugesan, Vice President of International and Business Development at Coinbase, expressed the company’s excitement regarding the Bank of Spain registration, highlighting the importance of regulatory clarity in the crypto industry. “Most of the world is stepping up to the plate and providing clarity and guidance for the crypto industry,” Murugesan said.

Spain’s Crypto-Friendly Stance

Spain has been progressively embracing the digital asset sector, with growing mainstream adoption throughout the country. Coinbase’s announcement noted that approximately 29% of Spanish adults view cryptocurrencies as the future of finance. Additionally, cryptocurrencies have gained popularity as the second most preferred payment method in Spain, surpassing traditional bank transfers.

According to Coinbase, a Bitnovo study revealed that 60.7% of Spanish citizens are motivated to invest in cryptocurrencies for the long term, while 35.7% use them for making payments. This positive sentiment aligns with the country’s increasing interest in digital assets.

Coinbase’s registration in Spain follows the regulatory approval granted to Crypto.com by the Bank of Spain in June, further underlining the growing recognition of the cryptocurrency industry by regulatory authorities and the increasing adoption of digital assets in Spain.

Coinbase’s European Expansion and Regulatory Landscape

Coinbase’s efforts to establish a strong presence in Europe reflect the evolving regulatory landscape in the global crypto market. Regulatory authorities outside of Europe are also exploring stricter oversight measures. The European Parliamentary Research Service (EPRS) has emphasized the need for a more robust regulatory framework in non-EU jurisdictions, especially as the Markets in Crypto-Assets Regulation (MiCA) Act approaches its implementation deadline in December 2024.

However, not everyone in the crypto sector is entirely content with the EU’s MiCA regulation. Marina Parthuisot, head of legal at Binance France, has raised concerns about the potential delisting of stablecoins in Europe due to the impending implementation of MiCA. The complexity of MiCA’s implications has left legal experts scrambling to understand its full scope as its enforcement date draws nearer.

In conclusion, Coinbase’s AML compliance registration in Spain is a significant step in the company’s European expansion efforts, reflecting the growing acceptance of cryptocurrencies in the region. As regulatory frameworks continue to evolve, the crypto industry is navigating a complex landscape, with both challenges and opportunities on the horizon.